COURSE OVERVIEW

This course provides a comprehensive foundation for beginning investors, focusing on practical skills and real-world application using the Robinhood platform. Students will gain confidence in making informed investment decisions while understanding the risks involved.

LEARNING OBJECTIVES

- Understand basic investing principles and market concepts

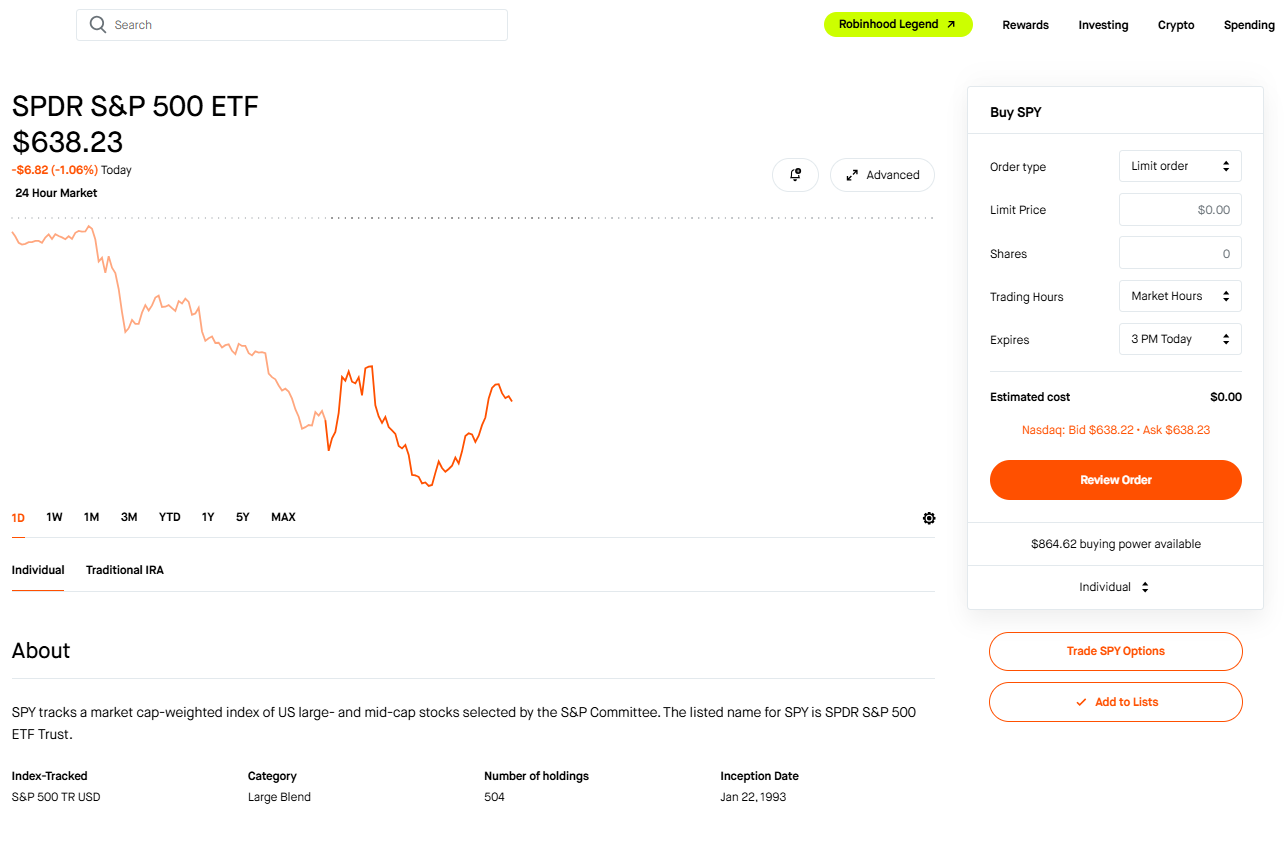

- Navigate and utilize the Robinhood mobile and web platforms

- Identify different investment types (stocks, ETFs, options, cryptocurrency)

- Master basic order types (market, limit, stop-loss)

- Recognize and mitigate common investment risks

- Develop fundamental analysis skills

- Create a personal investment strategy

- Understand the importance of diversification and long-term investing

Sep 22, 24, 29 & Oct 1, 2025

214 N Locust Street

Grand Island, NE